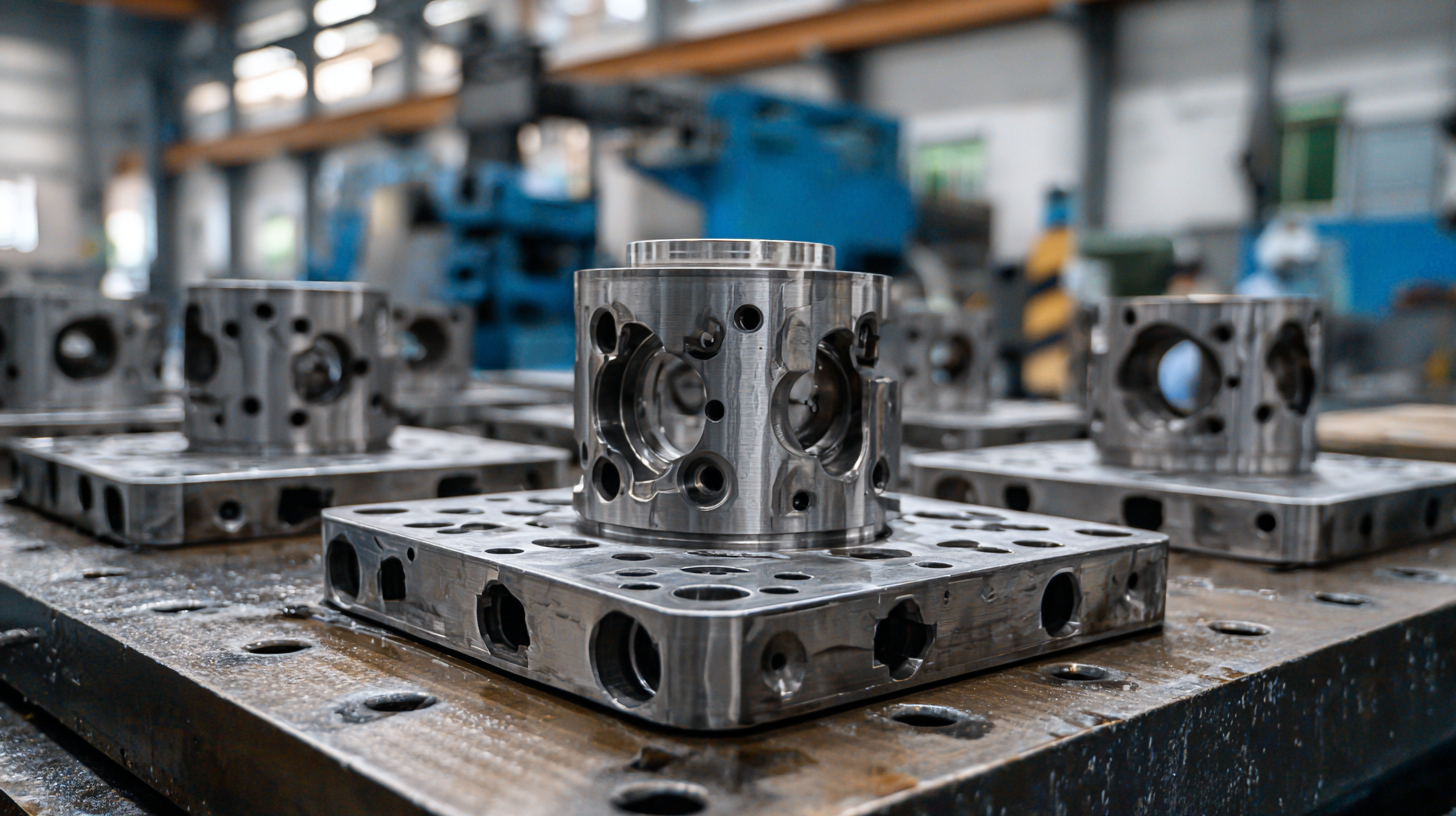

Investment casting has emerged as a critical process for producing high-quality components across various industries, significantly shaping the future of manufacturing. According to a recent report by Market Research Future, the investment casting market is projected to grow at a CAGR of 5.5% from 2021 to 2027, driven by increasing demand for precision parts in sectors such as aerospace, automotive, and healthcare. China's craftsmanship in this domain has garnered global recognition, positioning the country as a leading hub for producing investment casting parts that meet stringent quality standards. With technological advancements and an emphasis on sustainable practices, Chinese manufacturers are not only enhancing their production capabilities but also redefining the benchmarks for quality and efficiency in the investment casting landscape. This blog will explore how China's commitment to quality craftsmanship is propelling the investment casting sector towards a more innovative and sustainable future.

China's investment casting industry has seen remarkable growth, establishing itself as a dominant player globally. Recent statistics highlight that the nation is not only producing high volumes of casting parts but is also becoming synonymous with quality and innovation. As Chinese universities and companies enhance their research and development capabilities, the production processes for investment casting have evolved, integrating advanced technologies that boost precision and efficiency.

The shift towards advanced manufacturing techniques reflects China's strategic focus on driving innovation across various sectors. This transformation has positioned the country at the forefront of investment casting, where the emphasis on quality craftsmanship is paramount. The interplay of traditional skills with modern advances ensures that China is set to meet the diverse needs of global markets, making it an ideal partner for businesses seeking reliable and high-standard casting solutions. With an eye on future advancements, China's investment casting industry is poised for sustained growth and influence.

| Dimension | Value | Unit |

|---|---|---|

| Total Investment Casting Production | 4.7 | Million Tons |

| Market Share in Global Investment Casting | 40 | % |

| Growth Rate (2020-2023) | 8.5 | % |

| Number of Investment Casting Companies | 1,000 | Companies |

| Export Value of Investment Castings | 2.3 | Billion USD |

| Major Industries Using Investment Castings | Aerospace, Automotive, Oil & Gas | - |

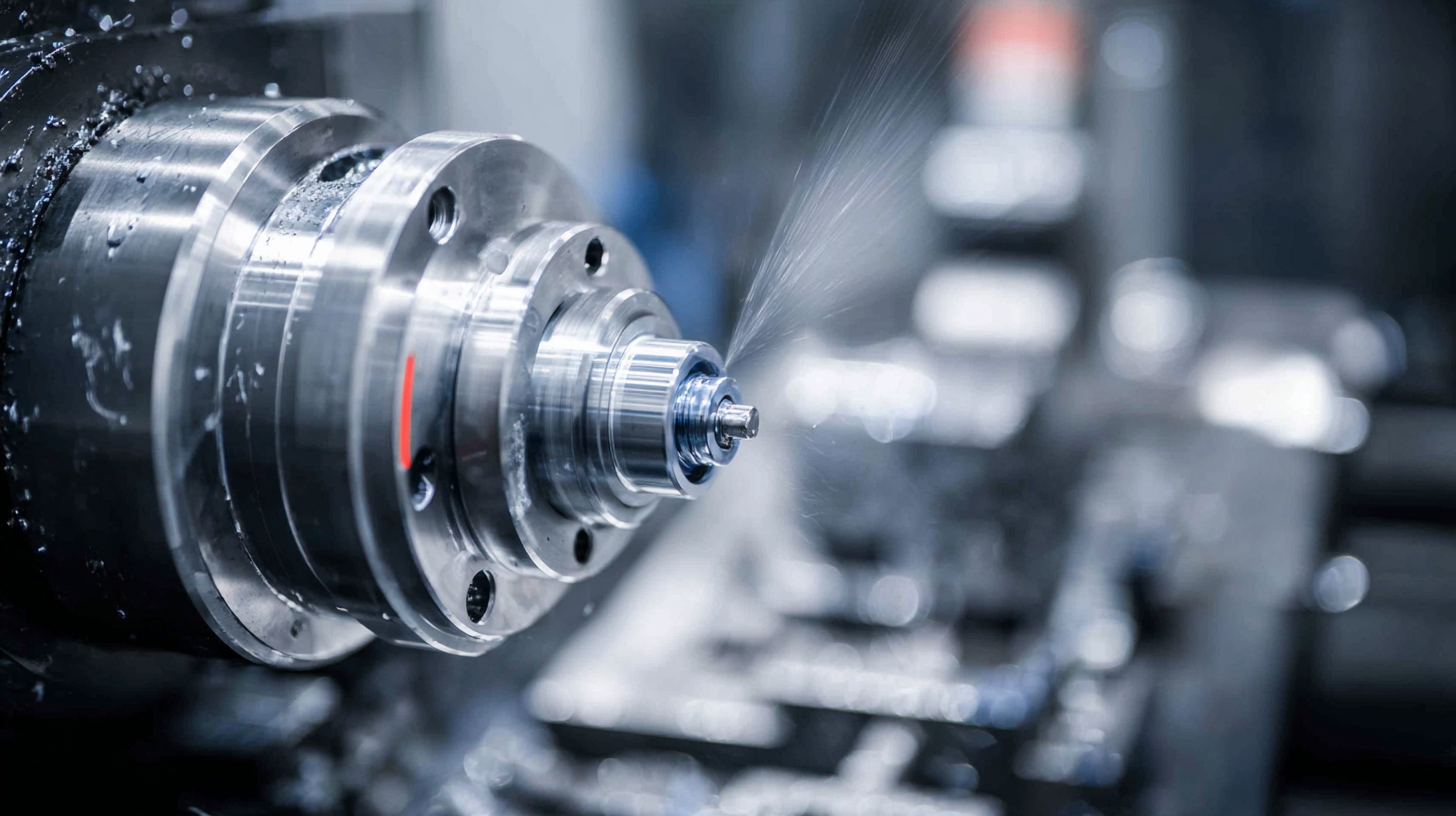

Investment casting, a precision manufacturing process, has seen significant advancements in recent years, particularly in China. As the industry continues to evolve, a comparative analysis of investment casting materials highlights the essential trade-off between strength and precision. According to a report by Grand View Research, the global investment casting market was valued at approximately $16.8 billion in 2020 and is projected to grow at a CAGR of 5.8% from 2021 to 2028. This growth is partly due to the increasing demand for high-performance components in sectors such as aerospace, automotive, and energy.

Investment casting, a precision manufacturing process, has seen significant advancements in recent years, particularly in China. As the industry continues to evolve, a comparative analysis of investment casting materials highlights the essential trade-off between strength and precision. According to a report by Grand View Research, the global investment casting market was valued at approximately $16.8 billion in 2020 and is projected to grow at a CAGR of 5.8% from 2021 to 2028. This growth is partly due to the increasing demand for high-performance components in sectors such as aerospace, automotive, and energy.

When evaluating materials used in investment casting, aluminum and stainless steel frequently emerge as frontrunners. Aluminum alloys, for instance, offer remarkable strength-to-weight ratios and are favored for applications where lightweight parts are critical. Reports indicate that aluminum castings can achieve a tensile strength of up to 300 MPa, making them ideal for aircraft components. On the other hand, stainless steel, while heavier, provides superior corrosion resistance and can sustain higher temperatures, with tensile strengths reaching 700 MPa. The choice of material ultimately depends on the specific requirements of the application, balancing the need for strength against the precision required in high-tolerance environments.

The investment casting market has significant variations in cost and quality across different regions, notably between China and the global landscape. China's advancement in quality craftsmanship has positioned it as a key player in the investment casting sector. Manufacturers in China leverage cutting-edge technology and a robust supply chain, which not only enhances production efficiency but also maintains high standards of quality. As a result, companies worldwide find that sourcing casting parts from China offers a superior cost-benefit ratio compared to local or other global alternatives.

When evaluating the cost-benefit ratio, several factors come into play. Lower labor costs in China reduce overall production expenses, while stringent quality control measures ensure that the products meet international standards. This combination allows global manufacturers to achieve high-quality outcomes without compromising their budgets. Additionally, the ability to scale operations quickly in response to market demands further reinforces China's position as a competitive investment casting hub, making it an attractive option for businesses aiming to optimize their manufacturing processes while securing durable and reliable parts.

China's investment casting industry has gained global recognition, primarily due to its stringent quality control standards that align with international benchmarks. According to a report by MarketsandMarkets, the investment casting market is projected to grow to $28.91 billion by 2025, with China accounting for a significant share. This growth is underpinned by investments in advanced technology and rigorous quality assurance practices, ensuring that products meet both domestic and international quality requirements.

The implementation of ISO 9001 and other relevant standards across Chinese foundries has revolutionized quality control processes. Data from the China Metal Casting Association indicates that more than 80% of foundries now adhere to these standards, significantly reducing defect rates. Furthermore, recent studies highlight that Chinese manufacturers have improved their process capabilities, achieving a first-pass yield rate of over 95% in producing complex parts. This emphasis on quality not only enhances the reputation of Chinese investment castings but also attracts global partnerships and investments, setting a competitive tone in the international market.

Investment casting is poised for significant transformation, driven by innovative technologies and strategic industry shifts. As global demand increases, particularly in aviation and automotive sectors, the investment casting market is expected to grow substantially. By 2025, the market value will reach approximately $8.5 billion, escalating to over $11 billion by 2033, with a compound annual growth rate (CAGR) of 3.3%. This growth reflects a robust investment in advanced manufacturing processes, enhanced materials, and automation, all aimed at improving efficiency and product quality.

Moreover, the sector will witness a surge in specialized applications like semiconductor production, specifically ultra-high purity (UHP) pipelines, projected to grow significantly from $427 million in 2025 to $750 million by 2033, showcasing an annual CAGR of 7.3%. This trend underscores the rising importance of investment casting in cutting-edge technologies. Furthermore, the electric vehicle (EV) segment is experiencing explosive growth, with casting components expected to thrive at a staggering CAGR of 45.34%. As China continues to refine its craftsmanship and technological capabilities, the future of investment casting is not just about meeting current demands but shaping the landscape of manufacturing excellence.